(Family Features) Infidelity and deception can take many forms in a relationship, including some that have nothing to do with romance at all. One example is financial infidelity, where deceptions are reported in nearly half of relationships where finances are combined.

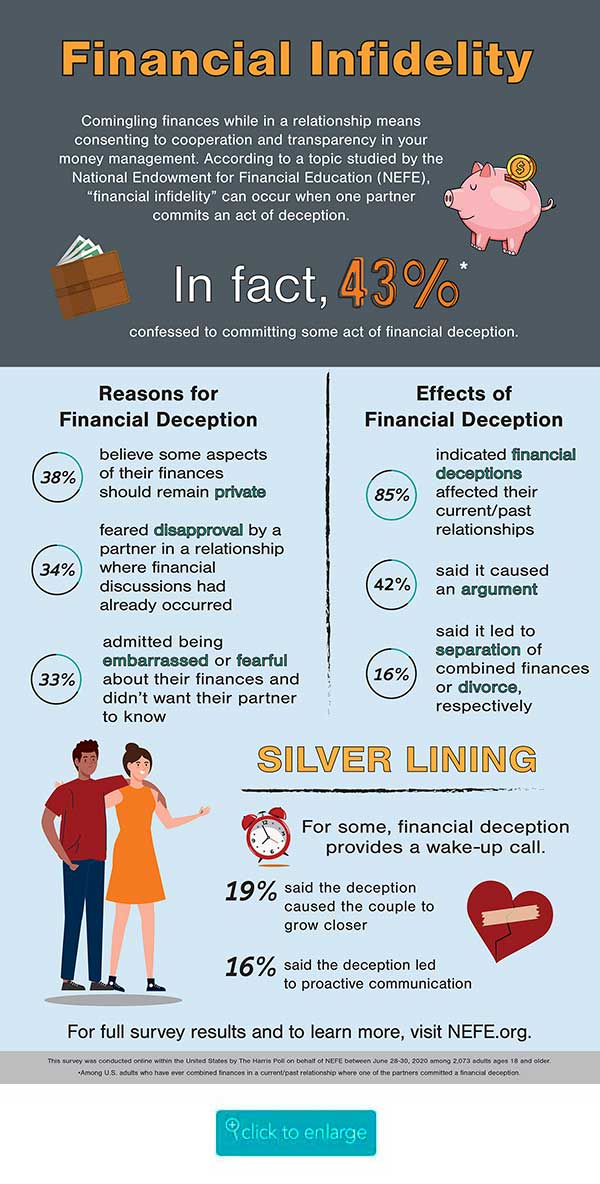

Among people who have combined finances with a partner, 2 in 5 (43%) confessed to committing an act of financial deception in a current or past relationship, according to a survey conducted by the National Endowment for Financial Education (NEFE). What’s more, 85% of those who reported a financial deception acknowledged the indiscretion affected the relationship in some way.

Among people who have combined finances with a partner, 2 in 5 (43%) confessed to committing an act of financial deception in a current or past relationship, according to a survey conducted by the National Endowment for Financial Education (NEFE). What’s more, 85% of those who reported a financial deception acknowledged the indiscretion affected the relationship in some way.

“When you comingle finances in a relationship, you’re consenting to cooperation and transparency in your money management,” said Billy Hensley, Ph.D., president and CEO of NEFE. “Regardless of the severity of the act, financial deception can cause tremendous strain on couples – it leads to arguments, a breakdown of trust and, in some cases, separation or even divorce.”

Understanding Financial Infidelity

A financial infidelity is an act of deception by one partner in a relationship where finances are combined. Examples include hiding purchases, money, or accounts, or lying about the amount of income earned and debt owed.

More than one-third (39%) of U.S. adults who have combined finances in a current or past relationship admitted to hiding a purchase, bank account, statement, bill, or cash from their partner, and about 1 in 5 (21%) admitted to lying to a partner or spouse about finances, the amount of debt they owe or the amount of money they earn.

Reasons for Financial Deception

Reasons for Financial Deception

A lack of communication and conflicting life or financial values may often be the root causes of financial deception, but U.S. adults also revealed other reasons for deceit with money. More than one-third (38%) said even though they are in a committed relationship, they believe some aspects of their finances should remain private. Meanwhile, another 33% were embarrassed or fearful about their finances and didn’t want their partner to know.

Fear of disapproval by a partner is also a powerful force, regardless of whether financial discussions are happening in the relationship. For example, 34% of U.S. adults who admitted to financial deception in a relationship with combined finances said they feared disapproval by their partner given discussions of finances had already occurred while 27% feared disapproval by a partner in a relationship where discussions about finances had not yet occurred.

How Financial Deception Affects Couples

Like other forms of infidelity, financial cheating can wreak havoc on a relationship, including arguments, loss of trust, less privacy, separating combined finances and even divorce. However, those who have been there offered some insight into positive repercussions, too, such as growing closer together and learning to communicate proactively.

Signs of Financial Infidelity

You may discover your partner is cheating financially when you come across a receipt or piece of paper indicating a purchase you don’t recognize or find your partner defensive or withdrawn in conversations about money. A deceptive partner may attempt to intercept bills via mail or email before you see them or remove the itemization of purchases on bills.

Learn more and find the full poll on financial deception at nefe.org.

Coming Clean

How to recover from financial deception

Whether you’ve caught your partner cheating when it comes to money, or you’re the one in the spotlight after making some financial transgressions, there are some steps you can take together to rebuild trust.

1. Be realistic in your expectations. Understand successfully rebuilding trust will take time, sustained transparency and commitment to shared goals, and increased communication.

2. Commit to open communication. While the conversations may be stressful, the key is to focus on understanding why the financial deception occurred and what you can do, together, moving forward.

“When 2 in 5 people admit to committing financial deception in a relationship where money is combined, it highlights the need for greater communication and a deeper understanding of who your partner is financially,” Hensley said.

3. Create goals and ground rules together. Finding areas of compromise can help you get on the path toward rebuilding trust. That might mean having separate personal accounts while maintaining a joint account for household expenses, or you might create separate accounts completely with each of you paying an equitable share of household expenses.

You could also establish guidelines you can both abide by, such as agreeing that neither will make a large purchase, such as items over $100, without discussing it together.

Photos courtesy of Getty Images

National Endowment for Financial Education